Payroll Solutions Tailored to Your Business

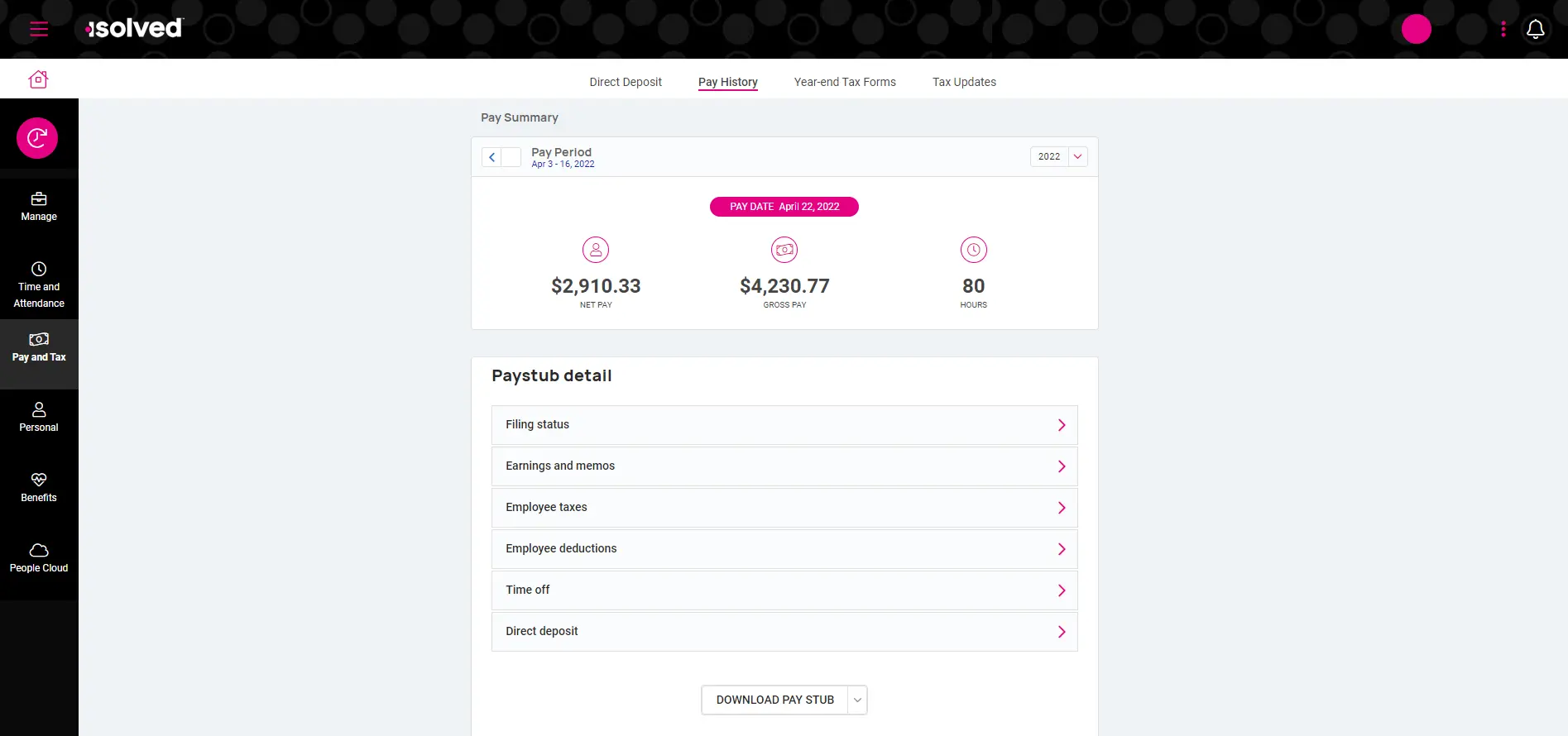

Payment History

Boost employee experience through simple, self-service access to personal data, pay stubs, W-2 forms, paid time off balances, and pending changes.

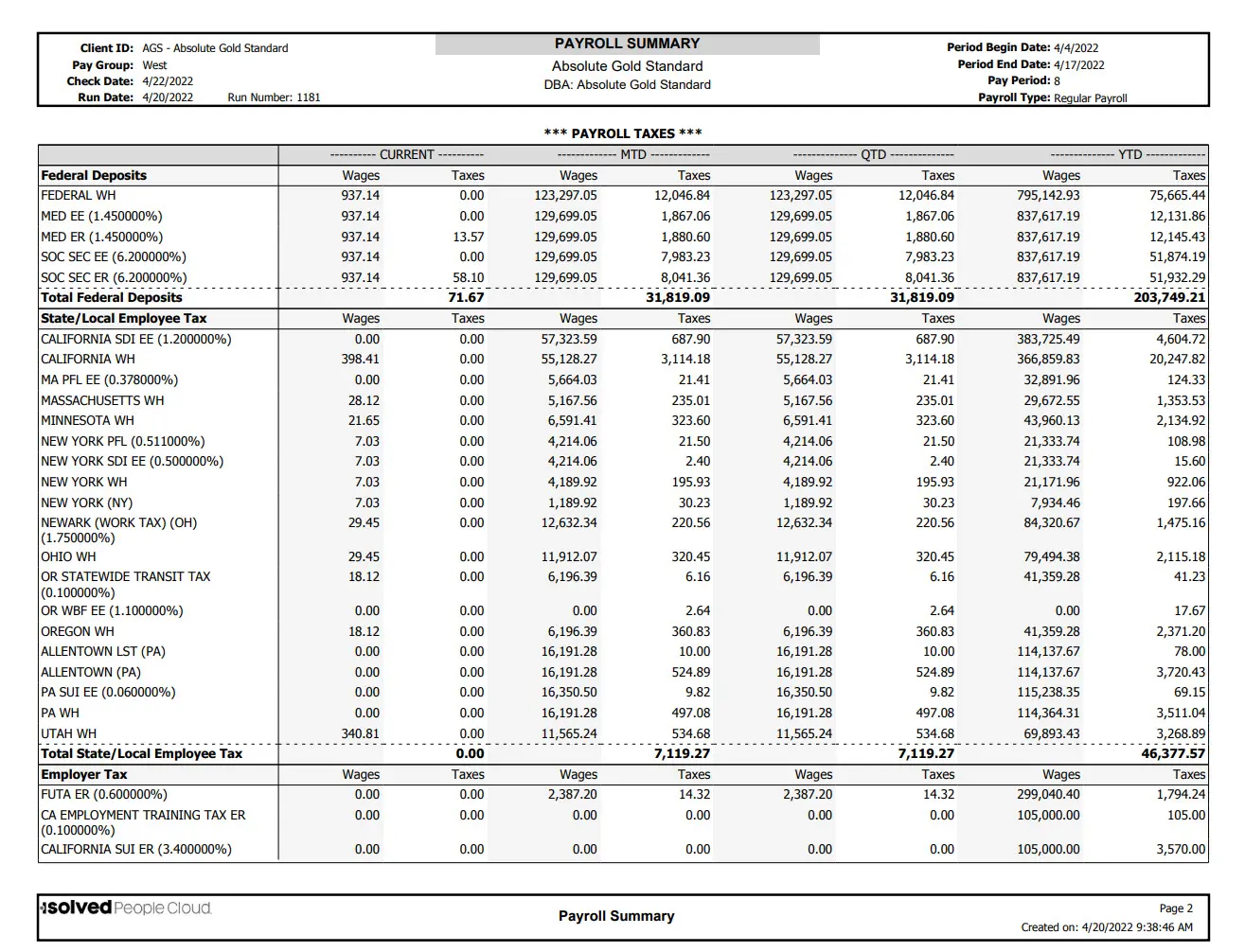

Payroll Summary

Create and view in-depth reports of your budget, taxes, workers’ compensation, and other payroll data to gain operational efficiencies and cost savings.

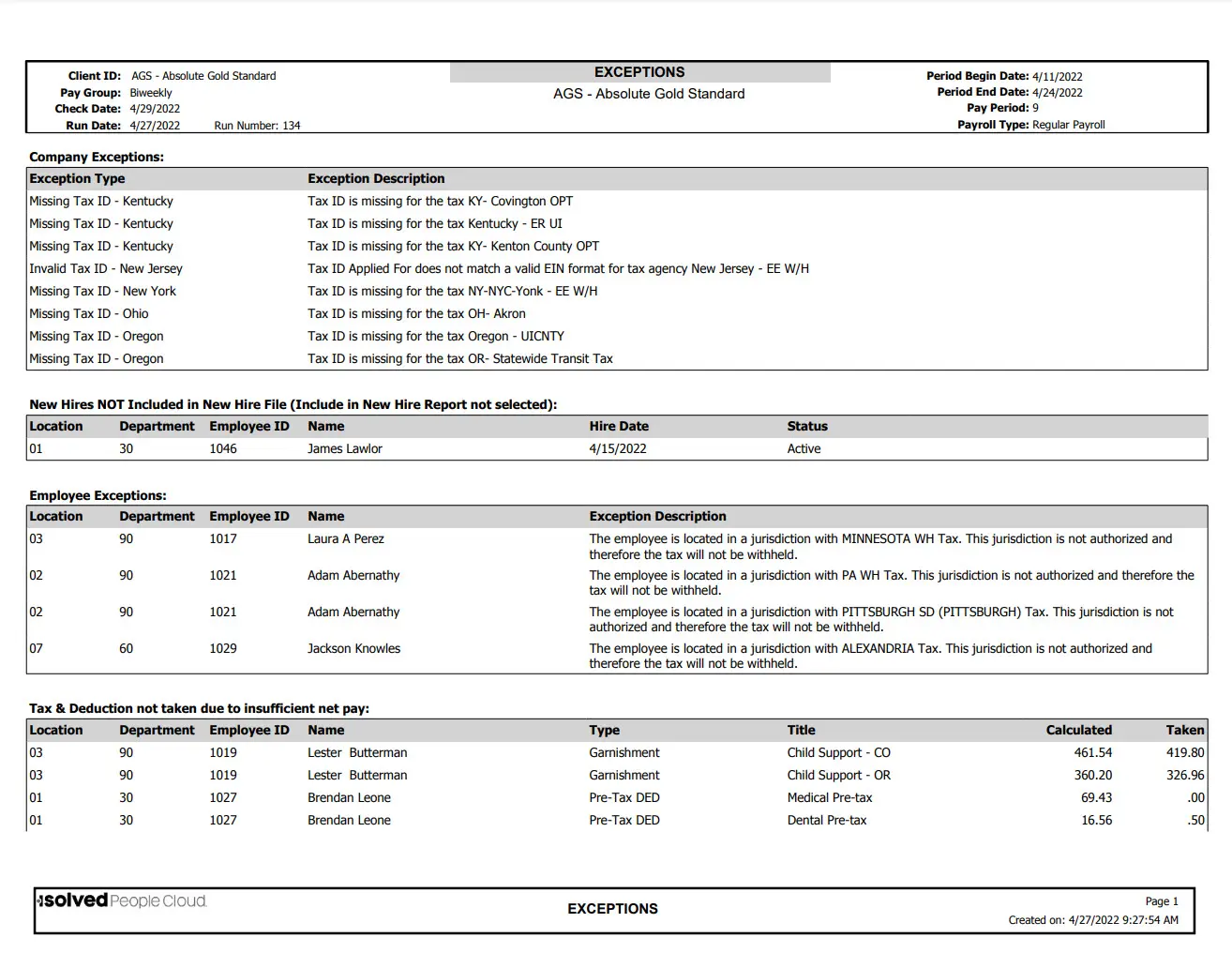

Visibility & Exceptions

Ensure visibility into potential errors before you process each payroll run to eliminate redundancies and avoid costly errors and penalties.

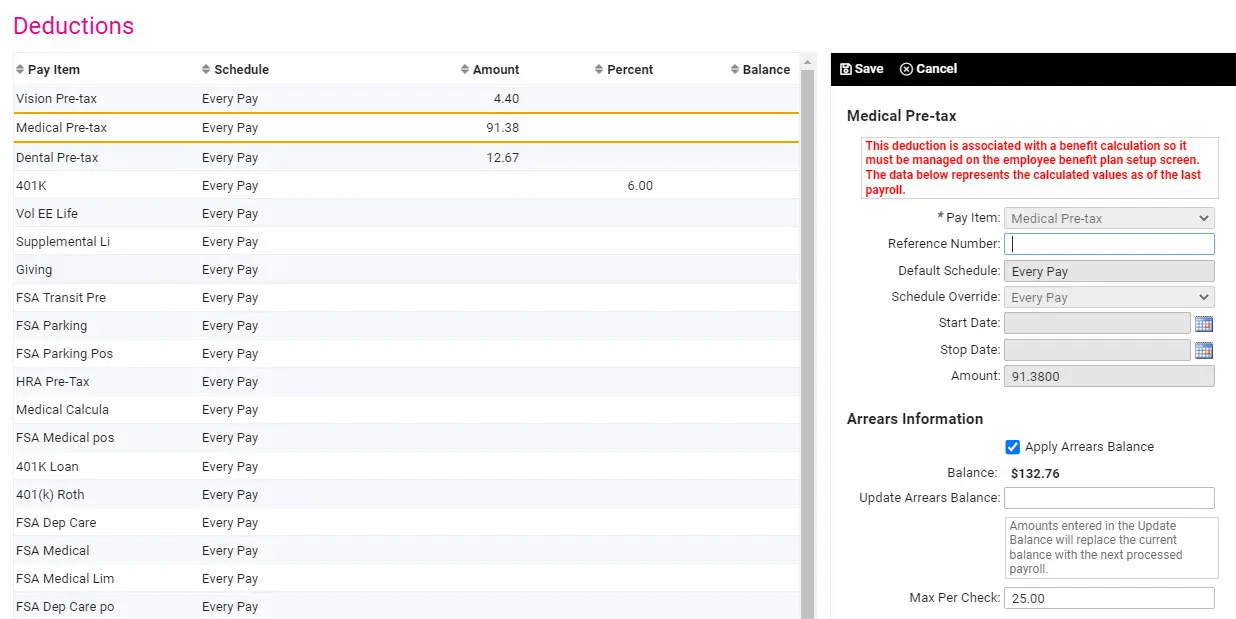

Deductions

Automate payroll adjustments for garnishments, benefit elections, workers’ compensation, bonuses, 401(k) plans, and corporate giving programs.